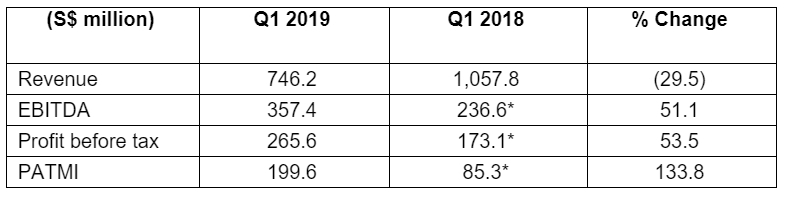

Singapore, 15 May 2019 – For Q1 2019, City Developments Limited’s (CDL) net attributable profit after tax and minority interest (PATMI) increased 133.8% to S$199.6 million (Restated Q1 2018: S$85.3 million), boosted by strong profit margins for development projects recognised this quarter and the realisation of a S$144.3 million pre-tax gain from the divestment of Manulife Centre, which is in connection with the Group’s second Profit Participation Securities (PPS) structure developed in 2015.

In terms of business segments, rental properties took the lead in Q1 2019, contributing 68% in pre-tax profits primarily attributable to the divestment of Manulife Centre and contributions from recent acquisitions. The property development segment was the next strongest contributor, largely supported by several of the Group’s key local projects including Gramercy Park, New Futura, The Tapestry, Whistler Grand, South Beach Residences as well as overseas projects like Hong Leong City Center in Suzhou and Hongqiao Royal Lake in Shanghai.

EBITDA increased 51.1% to S$357.4 million (Restated Q1 2018: S$236.6 million), underpinned by the strong contribution from the rental properties segment.

As at 31 March 2019, the Group’s net gearing ratio (without factoring any revaluation surplus from investment properties) stood at 36% with interest cover at 16.3 times and cash reserves at S$2.4 billion.

Operations Review and Prospects

Healthy residential sales in Singapore and China

- In Singapore, the Group and its JV associates sold 173 residential units with a total sales value of S$516.3 million (Q1 2018: 459 units with total sales value of S$792.6 million).

- In March 2019, the Group soft launched its ultra-luxurious 154-unit freehold JV project Boulevard 88 located along Orchard Boulevard. To date, 47 units including two penthouses have been sold at an average selling price (ASP) of over S$3,700 per square foot (psf).

- 98% of the 124-unit freehold New Futura at Leonie Hill Road have been sold to date at an ASP of over S$3,500 psf, with only three units remaining.

- At The Tapestry, the 861-unit condominium in Tampines Avenue 10, 619 units (72%) have been sold at an ASP of about S$1,350 psf.

- Whistler Grand, the 716-unit condominium at West Coast Vale, has sold 320 units and achieved an ASP of about S$1,380 psf.

- To date, 75 units at the 190-unit South Beach Residences on Beach Road have been sold at an ASP of about S$3,450 psf.

- In China, the Group’s wholly-owned subsidiary CDL China Limited (CDL China), together with its JV associates, sold 113 residential units and one villa in Q1 2019, achieving a total sales value of RMB 358.8 million (approximately S$72.0 million).

New and upcoming launches in Singapore

- On 4 May 2019, the Group’s freehold 592-unit JV project Amber Park in the East Coast area was launched. 115 units were snapped up on its launch weekend, surpassing market expectations and making Amber Park the best-selling new freehold property launch this year. The units were priced at an early-bird ASP of S$2,425 psf and total sales value achieved amounted to over S$240 million. To date, 145 units have been sold.

- The Group is preparing to launch another three projects in 2019:

- 188-unit Haus on Handy condominium in prime District 9, located a short walk from Plaza Singapura and Dhoby Ghaut MRT station – a three-line interchange station.

- 820-unit Piermont Grand, Singapore’s only EC launch for 2019, a JV waterfront development within 100 metres to Sumang LRT station and a 10-minute stroll to Punggol MRT station, bus interchange and Waterway Point Shopping Mall.

- JV project at Sengkang Central comprising about 680 residential apartments, a shopping mall, supermarket, hawker centre, and a community club with a child care centre, seamlessly integrated with Buangkok MRT station and a new bus interchange.

Accelerated development of fund management business

- In April, the Group acquired a 50% stake in IREIT Global Group Pte. Ltd., the manager of Singapore-listed IREIT Global, for about S$18.4 million and approximately 12.4% of the total issued units in IREIT Global for about S$59.4 million. This is in line with the Group’s aim to achieve AUM of US$5 billion by 2023. Besides being earnings accretive with immediate contribution to recurring income through management fees and attractive yields, the investment also strengthens the Group’s fund management expertise and establishes a track record for the Group in this arena.

Enhancement of recurring income

- In Q1 2019, the Group entered into an agreement to purchase a 70% stake in Shanghai Hongqiao Sincere Centre (Phase 2), a prime commercial property in the heart of Shanghai’s Hongqiao Central Business District, for RMB 1.2 billion (approximately S$247 million), equivalent to about RMB 49,000 per square metre (sqm). Spreading across 11 adjoining blocks, the property has a Gross Floor Area (GFA) of 35,739 sqm comprising offices, serviced apartments, a retail component and a basement car park with 384 lots. It is within 10 minutes’ drive to the Hongqiao Transportation Hub which consists of an international airport, railway and subway stations. It is also within 15 minutes' drive to the Shanghai National Exhibition and Convention Center. This acquisition is expected to complete by Q3 2019.

- In March 2019, the Group expanded into the rapidly-growing UK Private Rented Sector (PRS) with the acquisition of a £15.4 million (approximately S$27.5 million) 193,752 sq ft freehold site which is located only a 10-minute walk from Leeds Train Station and two kilometres to the Leeds City Centre. The Group plans to develop a 664-unit build-to-rent residential project with retail space within the site’s attractive heritage arches beneath a viaduct. Completion is expected in 2023.

- The Group’s two recently acquired Grade A commercial properties in UK are performing well. Both properties are under-rented and have strong potential for positive rental reversions. The Group is exploring several AEI initiatives for both properties to drive further upside.

Charting CDL’s next phase of growth in China

- In Q1 2019, the Group entered into a strategic partnership with Sincere Property Group (Sincere), an established real estate developer in China. The Group will invest RMB 5.5 billion (approximately S$1.1 billion), comprising both equity subscription and interest-bearing loans. Upon full completion expected by Q4 2019, the Group will indirectly hold approximately 24% equity stake in Sincere via its offshore investment vehicle, making the Group the second largest shareholder after Sincere's Founder and Chairman, Mr Wu Xu.

- Leveraging Sincere’s development and asset management capabilities, local expertise and wide geographical presence in China, the Group will be able to substantially expand its presence in China with development projects and investment properties.

- The Group will also contribute its international knowledge, best practices and networks to drive the JV’s future growth.

Mr Kwek Leng Beng, CDL’s Executive Chairman, said, “Our recent successful residential launches in Singapore indicate healthy demand for well-located projects that are exceptionally designed and sensitively priced. In Singapore, we have a launch pipeline of about 2,250 units comprising EC, mass-market, mid-tier and high-end segments. The Group is especially attentive to the planning and execution of these launches and we are confident that our new projects will generate strong interest due to their unique selling propositions and good locational attributes. While Singapore will always remain our home ground, our overseas efforts have borne fruit and provided much needed diversification to our earnings. Although global economic and political events have led to market uncertainties, our geographically diversified and income-stable portfolio in Singapore and overseas will enable us to better navigate through these challenges. At the same time, we will continue to actively explore attractive investment opportunities to grow our business.”

Mr Sherman Kwek, CDL’s Group Chief Executive Officer, said, “We have continued to accelerate our GET strategy of Growth, Enhancement and Transformation through multiple initiatives. With our recent spate of residential launches in Singapore, we have shown our ability to acquire good sites at the right prices and demonstrated that we have the required operational and sales expertise to ensure a strong execution. Our diversification strategy is on track and we continue to broaden our presence in our key overseas target markets. We also kickstarted our fund management business through our investment in IREIT Global’s fund manager and REIT as well as acquired two prime offices in the UK that could potentially seed a future fund. Most significant of all is our game-changing investment into Sincere Property Group, a transformational partnership that will fast track CDL’s growth in China with an enlarged portfolio and a substantial pipeline of development and recurring income properties. Looking ahead, we will remain strategic and disciplined in our acquisitions and continue to enhance our operational efficiency and execution.”