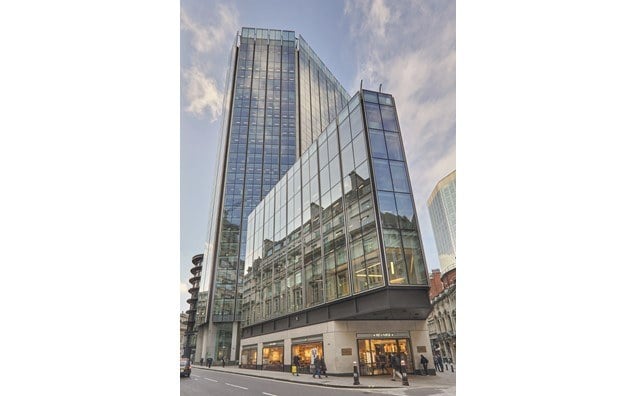

Singapore, 26 October 2018 – Marking its second London commercial property acquisition in 2018, City Developments Limited (CDL) has completed the purchase of a prime freehold Grade A office tower, 125 Old Broad Street, for £385 million (approximately S$687 million) or £1,170 psf (approximately S$2,088 psf). The property is strategically located in the heart of London and within the main financial district. Bounded by Old Broad Street, Throgmorton Street and Threadneedle Walk, it overlooks St. Paul’s Cathedral and is just 100 metres from the iconic Bank of England headquarters.

125 Old Broad Street enjoys excellent connectivity across Central London with seven Underground Stations within a 10-minute walk. Bank Station (the closest Underground Station) is 200 metres from the building, while Liverpool Street Station (the busiest transportation hub in the City of London, which will be served by the Crossrail) is about 400 metres away.

Formerly known as the Stock Exchange Tower, the property housed the headquarters, offices and trading floor for the London Stock Exchange until 2004. The landmark building was originally constructed in the 1970s and had undergone significant refurbishment in 2008. As one of only two high-rise towers in a conservation area, the building enjoys magnificent and unblocked views of the city’s skyline.

125 Old Broad Street comprises a Grade A office tower and ancillary retail space and has Net Lettable Area (NLA) of approximately 329,200 square feet (sq ft) spread over 26 floors with panoramic views of the city and three basement levels. It also has secured parking facilities.

The property provides a diversified and significant income stream with strong rental growth potential. It is fully leased to internationally renowned tenants, including Cushman & Wakefield’s European HQ, King & Spalding and China International Capital Corporation, with a passing yield of approximately 4.7%. At present, the top five tenants account for over 60% of the total NLA and income. With average passing rents currently about 25% below prime average rents in the City of London, there is strong potential for positive rental reversions. In addition, the property’s overall Weighted Average Unexpired Lease Term (WAULT) of 5 years (to lease breaks) and 5.4 years (to lease expiries) is attractive.

Mr Frank Khoo, CDL Group Chief Investment Officer, said, “In line with our strategy to grow our recurring income significantly over the next 10 years, this is our second London commercial property acquisition in 2018. We have confidence in the long-term fundamentals of London as a global financial hub with a robust office market. The short-term uncertainties surrounding Brexit have presented us opportunities to acquire assets with deep value. Capitalising on attractive pricing and yields, we have continued to expand our London commercial portfolio through strategic off-market acquisitions of high-performance assets. The tightening of London’s existing office stock and limited new supply will also drive rental growth into 2021. Given its excellent location in a diverse business district, 125 Old Broad Street will continue to attract a strong tenant mix from the finance, legal, insurance and technology/media/telecommunications sectors.”

In September 2018, CDL acquired Aldgate House, a prime freehold Grade A commercial building in London for £183 million. The property has NLA of approximately 211,000 sq ft and is located in the heart of Aldgate, one of London’s most vibrant districts. In addition, CDL owns the prime freehold Development House office building which was acquired in 2016 for £37.4 million. The 28,000 sq ft property at Leonard Street, Shoreditch district, will be redeveloped into a nine-storey building, increasing the NLA to over 72,000 sq ft.